I Was Raised on Dr. Seuss and the IRS Tax Code

A bedtime story

Children’s books are a staple in early childhood development. Hop on Pop, Green Eggs and Ham, The Cat in the Hat, IRS Tax Code. Okay, okay, maybe my mom didn’t read me the IRS tax code as a bedtime story, but I learned a lot about tax-exempt entities while I was growing up. Later it would help me in my fraternity. My mother, Sandra Englund, founder and CEO of RENOSI, is an attorney dedicated to setting up and helping tax exempt organizations operate. I can’t tell you how many dinner conversations wrapped around the nonprofit organization my parents started, Parent Booster USA (PBUSA), or how to make operating a 501(c)(3) organization easier.

What does this have to do with Greek Life?

Flash forward many years. I am 17, off to college as a music major, and know way more about the IRS tax code than anyone my age should. My first semester at college was a whirlwind. I changed my major, had 18 credit hours, and joined a fraternity, Alpha Tau Omega. At one of my first meetings as a lowly pledge, our treasurer pulled out an IRS letter. The chapter had been revoked of its tax-exempt status. No one knew what it meant or why it happened, but they were concerned. I raised my hand and announced, “I kinda know about this sort of thing. My mom works with tax-exempt organizations and I learned a lot growing up.”

The chapter lost its tax-exempt status because it failed to file three consecutive IRS 990s. The IRS 990 is the required annual tax filing for tax-exempt organizations. The solution was pretty easy. We started over.

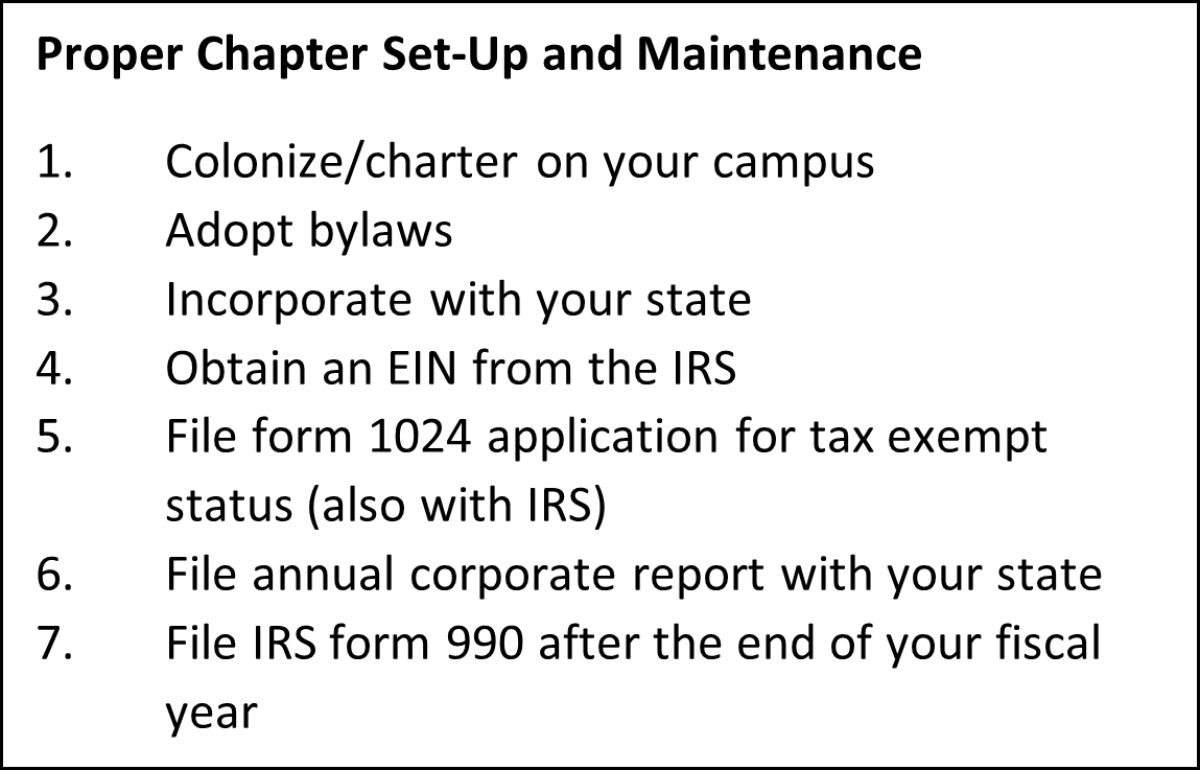

The chapter righted its ship by filing articles of incorporation with the state, and Form 1024 application for tax-exempt status with the IRS. We were sailing again with our corporate shield in place until they weren’t.

Flash forward a few years. I’ve graduated, become a proud ATO alumnus, and joined the family business. My college fraternity has lost both it's corporate standing with the state, and tax-exempt status with the IRS. They call me for help.

Where was the national fraternity?

At this point you may be asking, where is the national fraternity?

Unfortunately, national fraternities usually help with the start-up of new chapters, but don’t help with the state and federal government filings required to keep the chapters in good status. Our treasurer took the IRS letter to our national leadership consultant. His response was, “yep y’all need to handle that”.

I’ve learned that national fraternities take a “minimal supervision approach”. This means they get chapters set up, and then let the chapters run themselves with minimal oversight. This approach limits the liability of the national group because they distance themselves from the local entity should something bad happen. The problem is, when chapters lose their corporate status with the state, they also lose the liability protection incorporation provides. This means that the chapter’s officers and directors may be personally liable should something bad happen.

We have to make this easier

It hurts me to say this, but I’ve become my mother. I can’t stop thinking about how to make operating a Greek chapter easier for students. I knew when I started working with RENOSI (Registration for Nonprofits Simplified) after college that I wanted to use RENOSI’s resources and know-how to help Greek chapters stop losing their state corporate and IRS tax-exempt status.

Introducing Greek Boss!

When I went through the ordeal of explaining the IRS issue to my brothers, and trying to walk them through why it mattered, it felt like I was talking to a brick wall. I wished there was something I could hand my brothers that would catch their attention and not just leave me holding the bag. It didn’t exist.

And so, I created it! Introducing Greek Boss, a short online course that covers the basics of keeping Greek chapters in good standing with their state and the IRS. Now I know students won’t start voluntarily reading the IRS Tax Code. So how do we create an online course about taxes that students will read? The answer? We made it short, and rather sassy. We filled the course with cheeky anecdotes and lessons that take less time to read than cooking ramen.

And then we made it free. Greek Boss is online, easy to access, and you don’t even need to call us to get started (but we’d love it if you would). Why such a deal? Because we want to introduce RENOSI and how we can keep your schools’ Greek chapters stay up to date with required state corporate and federal (IRS) filings.

Lots of volunteer-led organizations, not just fraternities and sororities, lose their state corporate and federal (IRS) tax-exempt status each year. In the case of Greek chapters, we find that about 70% are out of good standing…which means sailing without the liability protection corporate and tax-exempt status provide. RENOSI solves this problem by filing the paperwork for the organizations, and keeping the groups’ government documents filed in the “cloud” so next year’s officers and directors, and the following years, will know what was filed, when it's due, and won’t get revoked. Yep, all that making it easier stuff my mom was preaching about around the dinner table when I was a kid.

Take a look at Greek Boss Today!

What are you waiting for? Take a look at Greek Boss today. See how short, and sassy it really is, and introduce it to your Greek chapters.

When it comes to maintaining IRS compliance there really isn’t much to it. File a 990 every year and rarely is anything else needed to maintain tax exempt status. The 990 is due on the 15th day of the fifth month after an organization’s fiscal year closes. For example, if your fiscal year ended on June 30th your 990 would be due by November 15th. To make matters a little more complicated there are three common different versions of the 990 all based on the organization’s total income.

RENOSI is the leader in helping national organizations set up and manage affiliate chapters. Setting up local, regional and state affiliate chapters is an excellent way to grow your national organization. Managing hundreds and even thousands of chapters, however, is time-consuming and difficult.

Since its inception, RENOSI has provided a simple and stress-free solution to help obtain and maintain tax-exempt status for over 6,000 nonprofits. With the interactive myRENOSI dashboard, our partners can organize their state and federal registrations, allowing our team of experts to help ensure your tax-exempt status is not revoked.