Proving 501(c) status.

What should RENOSI clients provide to donors?

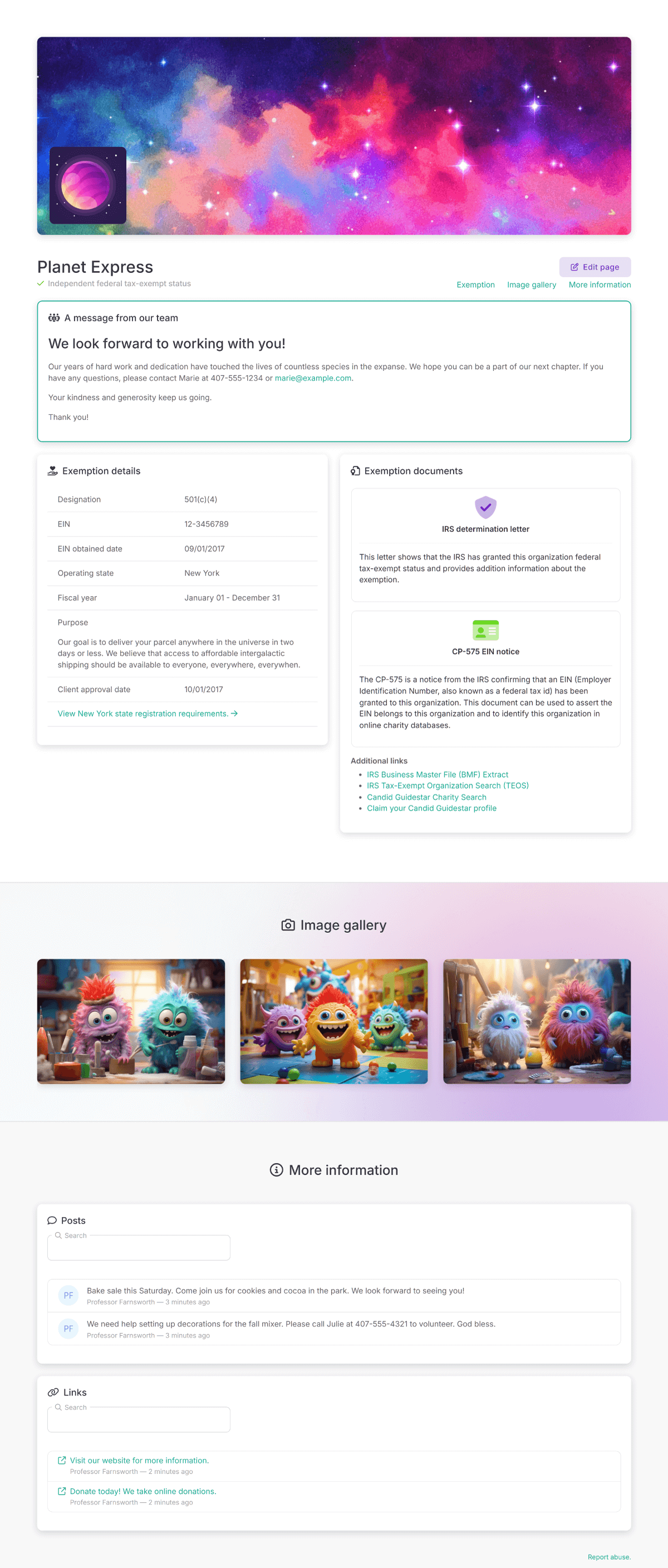

Clients of RENOSI with independent IRS federal tax-exempt status should provide donors with:

- their IRS determination letter

- their CP-575 letter verifying their EIN

What if our organization is not yet listed in the IRS Business Master File (BMF)?

Many donor platforms rely on the BMF as their main source to verify tax-exempt status. It can take around a year or sometimes longer for organizations to appear in the BMF.

Nonprofits in the process of applying for independent tax-exempt status can share a copy of their 1023-EZ, 1023, or 1024 application with donors as proof they've applied. The IRS has stated that it allows organizations to operate as nonprofits in good faith while awaiting approval. If any attached schedules include private information, they can (and should) be removed before sharing the packet.

Are there any other sources of online information for donors?

It's important that organizations claim their profile on GuideStar, another tool used by donors to look up charity information. Subordinates of group exemptions are typically listed under the parent organization's name in the BMF, with the subordinate name in a separate column. GuideStar allows charitable organizations to claim their profile and update the display name to reflect the organization's actual business name within their system.

Finally, the IRS Tax-Exempt Organization Search (TEOS) can be used to find information about exempt organizations, including determination letters and past Form 990 filings.

Show off your organization!

RENOSI offers a unique tool for its client organizations that allows them to quickly and easily share information with donors, volunteer, and the public, including important exemption documents, links, posts, an image gallery, and more. Get started with crafting your perfect public presence today!