DIY - Guide for Filling Out IRS Form 990

Resource

Supporting files

-

RENOSI Guide for Filling Out IRS Form 990.pdf

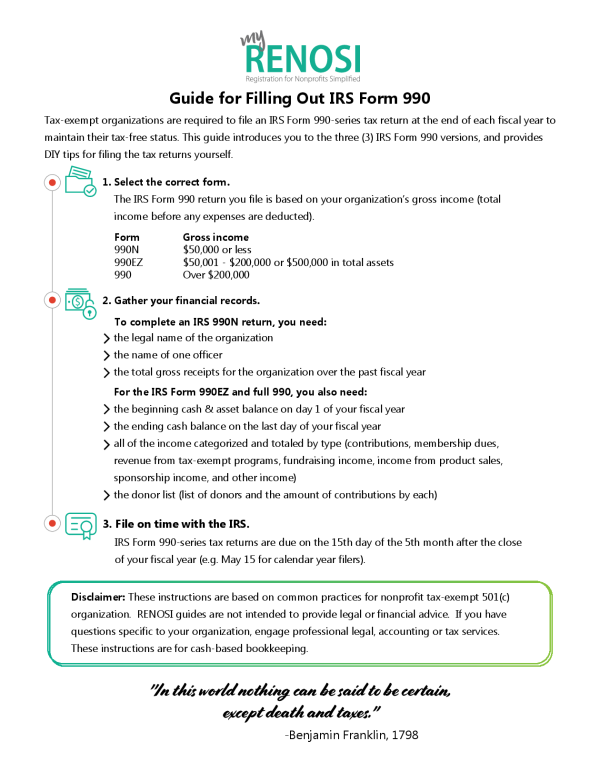

Tax-exempt organizations are required to file an IRS Form 990-series tax return at the end of each fiscal year to maintain their tax-free status. This guide introduces you to the three (3) IRS Form 990 versions, and provides DIY tips for filing the tax returns yourself.

Feeling lucky?

Or maybe try one of these...